Warren Buffett Warned Us in 2003: The U.S. Trade Deficit Is a Time Bomb

His 20-year-old idea to fix it? A quiet echo in today’s turbulent economic landscape

As the world grapples with the fallout of escalating trade tensions and a collapsing global stock market, an old voice rings newly relevant: Warren Buffett, the legendary “Oracle of Omaha,” may have predicted it all two decades ago.

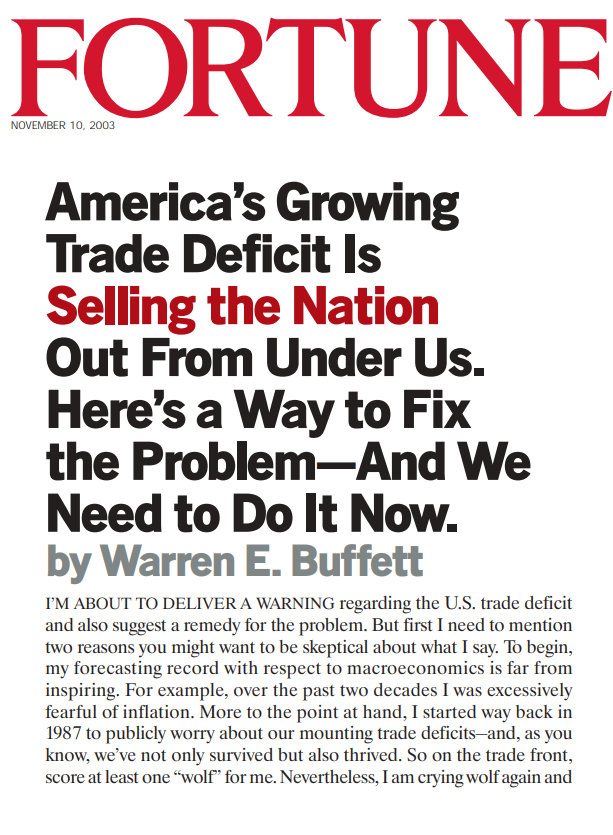

Back in 2003, Buffett published an article in Fortune Magazine titled:

“America’s Growing Trade Deficit Is Selling the Nation Out. Here’s a Way to Fix It – and We Need to Do It Now.”

Today, with the United States once again under the microscope for its deepening trade imbalances and protectionist measures echoing Trump-era policies, many are dusting off Buffett’s warning and asking: Was he right all along?

Thriftville vs. Squanderville: A Parable That Hits Harder Today

Buffett’s warning wasn’t just numbers and charts. He used a metaphor—almost childlike in tone but devastatingly accurate: Thriftville and Squanderville.

Two identical islands.

- In Thriftville, people worked 16 hours a day, consumed only what they needed, and exported the rest.

- In Squanderville, people stopped working, lived off imports, and paid for it with “Squanderbonds”—promises to repay in the future.

Over time, Thriftville accumulated debt assets. Squanderville was left with a mountain of liabilities and the looming need to repay, eventually, with hard work.

Buffett’s analogy mirrored the U.S. trade deficit:

“We're behaving like a rich family selling off the farm to sustain its lifestyle.”

The U.S. Trade Deficit: A Persistent, Self-Inflicted Wound

For decades, the U.S. has imported more than it exports, covering the difference by:

- Selling assets

- Issuing debt bought by foreign powers like China

Despite appearing stable, Buffett warned:

“The national credit card is not infinite.”

Today, those fears resurface. The U.S. dollar remains dominant, and trust in American credit holds—but cracks are appearing. Rising debt, reliance on foreign manufacturing, and deteriorating trade balances are renewing old concerns.

Buffett’s Bold Solution: Import Certificates

In that 2003 piece, Buffett proposed a radical yet neutral mechanism:

Import Certificates (ICs)

- Exporters receive a certificate equal to their export value

- Importers must purchase ICs to be allowed to import

This system would:

- Balance trade automatically

- Encourage exports

- Avoid traditional protectionism

- Preserve the dollar’s value

Yes, it would make imports more expensive—like a hidden tax—but it would also:

- Boost domestic industries

- Create local jobs

- Reduce foreign dependency

Are Buffett’s Ideas “Trumpian”?

In recent weeks, some commentators have drawn parallels between Buffett’s Import Certificates and new tariffs promoted by Trump advisors in 2025. An idea once considered too radical is now being echoed—possibly even implemented—under the radar.

Despite Buffett’s reputation as a moderate, his views on trade have long aligned with certain economic nationalist arguments. Still, as he said himself:

“There may be better solutions than mine. But what certainly won’t work is doing nothing.”

Does 2025 Buffett Still Believe in 2003 Buffett?

That’s the million-dollar question.

With Buffett again at the center of economic conversation—as the only billionaire who profited during a historic market crash—analysts and investors alike wonder:

Would he still support Import Certificates today? Or has his view evolved?

We don’t know. But as Charlie Munger, his late partner, once said:

“I just want to know where I’m going to die, so I don’t go there.”

Buffett may not have all the answers—but he's always known how to ask the right questions.