Sharp Decline in Atlanta Fed GDPNow Forecast Signals Potential Economic Contraction in Q1 2025

From Growth to Contraction: A Rapid Shift in U.S. GDP Expectations

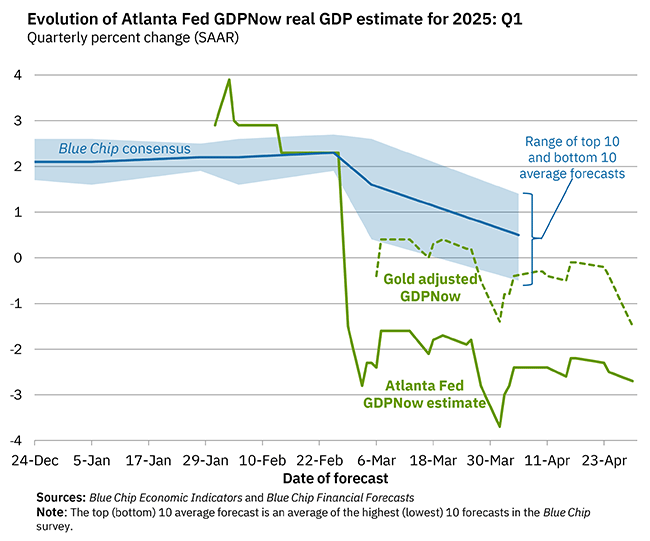

The latest data from the Federal Reserve Bank of Atlanta's GDPNow model reveals a striking downturn in economic expectations for the first quarter of 2025. The forecast, which measures real GDP growth at a seasonally adjusted annual rate (SAAR), plummeted from above 3% in late January to below -2.5% by late April, marking a potential shift from expansion to contraction.

Key Trends from the Chart:

- The Atlanta Fed GDPNow estimate (solid green line) began near 2%, aligning with the Blue Chip consensus (blue shaded area).

- Around early March, the estimate experienced a dramatic fall, dropping to nearly -3% within days—a shift not mirrored by the consensus forecasts.

- A secondary metric, “Gold adjusted GDPNow” (dashed green line), showed a more moderate decline, stabilizing near 0% to -1%.

- Meanwhile, the Blue Chip consensus (dark blue line) held steady above 1.5%, suggesting a growing divergence between institutional consensus and real-time modeling.

Notes & Observations:

- The discrepancy between GDPNow and Blue Chip consensus raises concerns over forecasting volatility or potential data interpretation errors.

- The range of top and bottom 10 Blue Chip forecasts indicates considerable uncertainty, even among professional forecasters.

- The exact causes of the March plunge in the GDPNow model remain unclear in the data presented, warranting further investigation.

Takeaway:

This divergence between real-time GDP models and traditional forecasts could indicate underlying economic stress or model recalibration. Whether the U.S. economy is truly on the brink of contraction—or if this is an overcorrection by GDPNow—remains a topic of intense scrutiny.