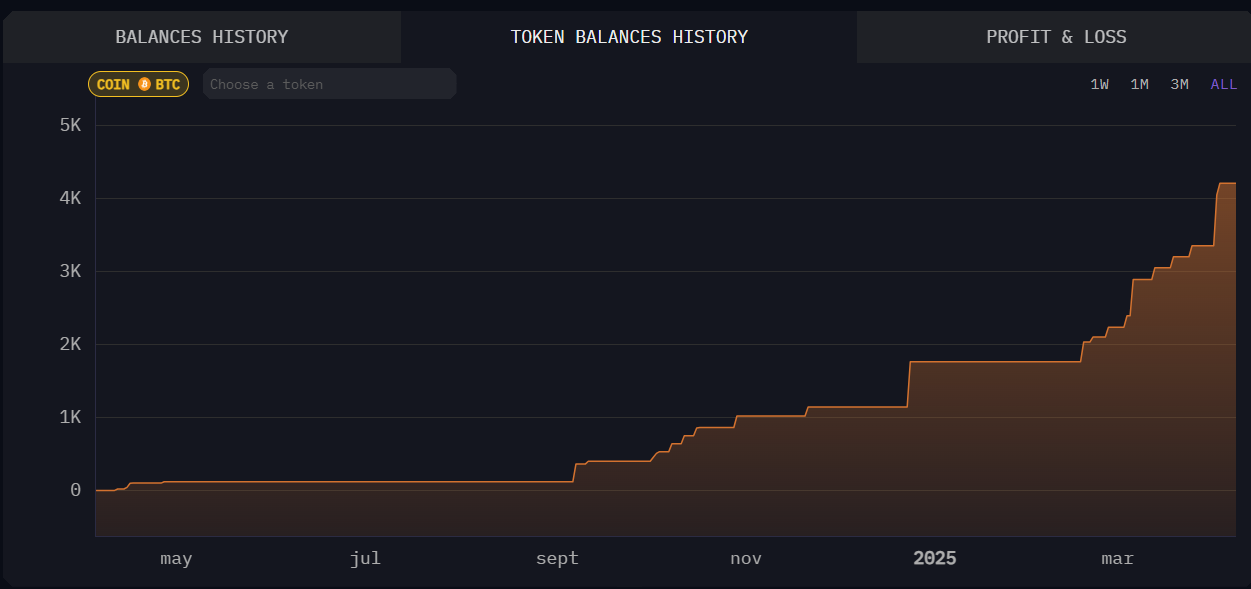

Metaplanet Adds 319 BTC, Total Holdings Reach 4,525 Bitcoin

Metaplanet Inc. (TYO: 3350), a Japanese investment firm, has made headlines with its latest acquisition of 319 Bitcoin (BTC), purchased at an average price of $83,147 per coin. This strategic move pushes the company’s total Bitcoin holdings to 4,525 BTC, valued at a cumulative acquisition cost of $408.1 million — averaging $90,194 per BTC.

A Bold Financing Strategy

This aggressive accumulation of Bitcoin further solidifies Metaplanet’s position as a corporate leader in digital asset adoption, especially in the Asian market.

To support its growing digital treasury, Metaplanet has turned to an innovative blend of equity and debt financing. Since January, the firm has issued over 21 million shares under its ambitious “Plan 210 million”, successfully raising more than ¥35 billion — about 42% of the total target issuance.

The latest round of financing involved the exercise of the 14th and 17th stock acquisition rights series, reinforcing the company’s capacity to self-fund its Bitcoin expansion strategy.

In addition to equity issuance, Metaplanet has leveraged zero-coupon bonds. Notably, the company fully redeemed its 9th bond series, originally scheduled to mature in September 2025. This early redemption was funded using proceeds from EVO FUND, a strategic capital partner. On March 31st, Metaplanet announced the issuance of a new bond series worth ¥2 billion (~$13.3 million USD) to maintain momentum.

Bitcoin as Strategic Treasury Reserve

Metaplanet’s strategy highlights a growing trend among public companies — especially in Asia — of adopting Bitcoin as a strategic treasury reserve asset. This trend continues despite ongoing regulatory scrutiny, signaling a shift in how companies are approaching long-term financial resilience and capital preservation.