Lessons from the Nifty Fifty: What the 1970s Teach Us About Today’s Growth Stocks

“It wasn’t a bubble — it was a test of endurance.”

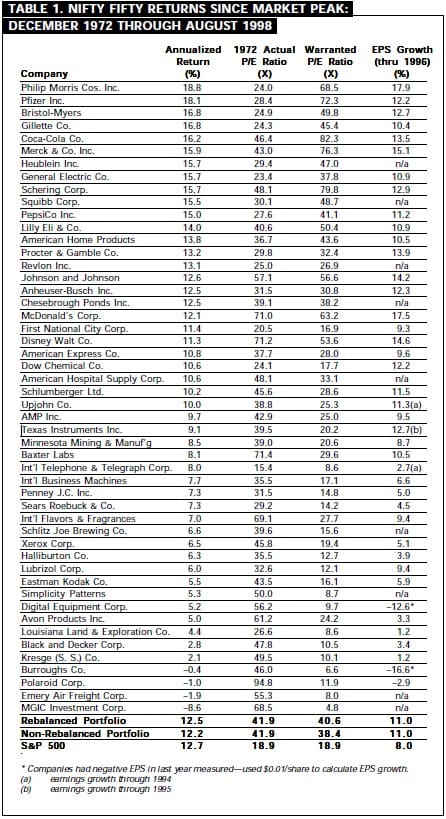

In the early 1970s, a group of elite growth stocks known as the “Nifty Fifty” — including Coca-Cola, Procter & Gamble, Johnson & Johnson, Walt Disney, American Express, and Pfizer — delivered exceptional returns, achieving near-mythical status on Wall Street.

At their peak in late 1972, these stocks were trading at an average price-to-earnings (PE) ratio of 42x, more than double the S&P 500’s 19x. However, the landscape changed dramatically in 1973 and 1974, as surging inflation and a sharp recession sent markets tumbling. The Nifty Fifty stocks underperformed severely, prompting many to view the episode as a speculative bubble that had burst.

But was it really a bubble?

Rewriting the Narrative: Long-Term Triumph

Despite their short-term collapse, if investors had held these stocks from their 1972 peaks, they would have realized long-term annual returns above 12%, on par or better than the broader market.

Coca-Cola, for example, traded at a lofty 46x PE in 1972 — yet still returned an astonishing 16.2% annually. Based on backward-looking fair value models, even a PE of 82x would have still delivered average S&P 500-level returns.

By contrast, Xerox, also trading at 46x PE, generated just 6.5% annual returns, showing that high valuation alone wasn’t the issue — but rather long-term earnings growth.

The 1970s: A Decade of Pain and the Power of Belief

From 1972 to 1982, the U.S. economy faced three recessions and inflation topping 15%. The S&P 500 delivered only 6.7% annual returns, and the Nifty Fifty fared even worse. Yet once Paul Volcker and the Federal Reserve finally tamed inflation by pushing interest rates to 20%, markets surged.

The lesson? Markets respond more to expectations than to current numbers.

When investors believe inflation will stay high, PE ratios compress sharply. But once confidence returns that inflation will normalize, valuations bounce back — quickly and dramatically.

What This Means Today

At the end of 2021, high-quality growth stocks again traded at premium valuations. Since then, inflation concerns and fears of stagflation — a rare economic cocktail of high inflation + low growth — have sent those valuations tumbling.

But if history is any guide:

- If inflation persists for a decade, returns may stay muted.

- If inflation is controlled within a few years, today’s depressed prices may offer once-in-a-decade buying opportunities, especially in durable growth names.

As we saw with the Nifty Fifty, companies that delivered consistent growth — like Coca-Cola — not only survived high valuations but outperformed the market in the long run.