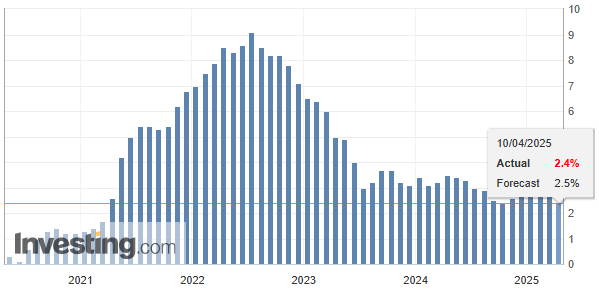

Inflation Falls to 2.4% as Fed Weighs Trump’s Tariff Pause

March sees lowest annual inflation rate since September, raising questions ahead of Federal Reserve’s May meeting

In a surprising turn for the U.S. economy, inflation cooled to 2.4% in March, marking a notable decrease from 2.8% in February, according to the latest figures released by the U.S. Department of Labor. This represents the lowest annual inflation figure since September, signaling a potential turning point in the Federal Reserve's battle against persistent price pressures.

The decline in inflation comes just weeks before the Federal Reserve’s critical policy meeting in May, with financial analysts now speculating whether this trend could prompt an earlier-than-expected interest rate cut. For now, the Fed has maintained its benchmark rate, though it has hinted at possible rate reductions by the end of 2025.

Complicating the economic landscape is President Donald Trump’s recent decision to pause some tariffs for 90 days, a move that followed his sweeping announcement just a week earlier of new duties affecting nearly 60 nations. The initial announcement rattled financial markets and triggered sharp declines in both business and consumer sentiment.

Despite the temporary pause, the administration has maintained key tariffs, including:

- A 125% tariff on all imports from China

- 25% duties on steel, aluminum, imported cars, and many products from China and Mexico

These remaining tariffs could still contribute to moderate inflationary pressures later in the year, experts caution.

A major contributor to March's inflation decline was the drop in gasoline prices, underscoring how energy costs can influence broader economic trends. When volatile food and energy prices are excluded, core inflation also eased to 2.8%, down from 3.1% in February—marking the second consecutive monthly decline in core prices.

“Core inflation is viewed as a more stable indicator of future trends,” said one analyst. “This back-to-back easing is a positive sign, but the tariff situation continues to cloud the outlook.”

Looking Ahead: A Balancing Act for the Fed

While the recent data suggests inflation may finally be subsiding, uncertainty looms. The Fed’s dual mandate of price stability and full employment remains at the center of policy decisions. Should inflation continue its descent, a rate cut may be on the horizon, though remaining tariffs and global market volatility are key risks.