Gold Breaks the Rules: A New Financial Era in the Making?

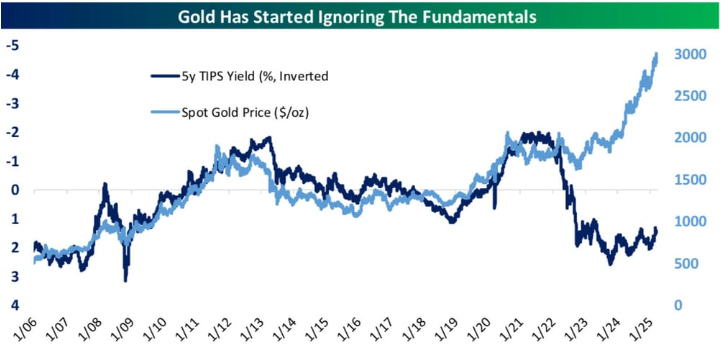

For decades, gold prices have moved largely in tandem with real long-term interest rate expectations. Since the early 1970s—particularly after the Nixon Shock ended the dollar’s convertibility to gold—analysts have relied on this relationship to forecast gold’s direction. Typically, when real interest rates (as measured by TIPS yields) fell, gold prices rose, and vice versa.

However, as the chart above vividly illustrates, this relationship has significantly diverged in recent years.

A Pivotal Shift in 2022

Since the spring of 2022, when Western nations froze approximately $300 billion in Russian foreign reserves in response to the Ukraine invasion, gold appears to have decoupled from its historical macroeconomic driver.

Despite 5-year TIPS yields (inverted in the chart) falling deeper into negative territory—which traditionally would signal lower gold prices—the spot price of gold has surged, surpassing $2,500/oz and approaching $3,000/oz.

“Gold has started ignoring the fundamentals,” the chart title states—and the data supports this assertion.

What’s Driving Gold Now?

The traditional macroeconomic models no longer seem to fully explain gold’s behavior. This post-2022 era signals a paradigm shift. Gold may now be:

- Reacting more to geopolitical risk than inflation or real yields.

- Viewed as a hedge against systemic financial and sovereign risk rather than just monetary policy.

- Regarded increasingly as a store of value outside traditional Western financial systems.

Looking Ahead: A Bullish Outlook?

Given this new dynamic, gold may continue its bullish trajectory in the coming years—not despite real interest rate fundamentals, but independently of them. As central banks and global investors reconsider the security of reserves held abroad, gold could be reasserting itself as a neutral, sovereign-proof asset.