Abraxas Capital Buys $250M in Bitcoin Ahead of Easter Calm

London-based firm makes major Bitcoin acquisition as market eyes low volatility Easter weekend

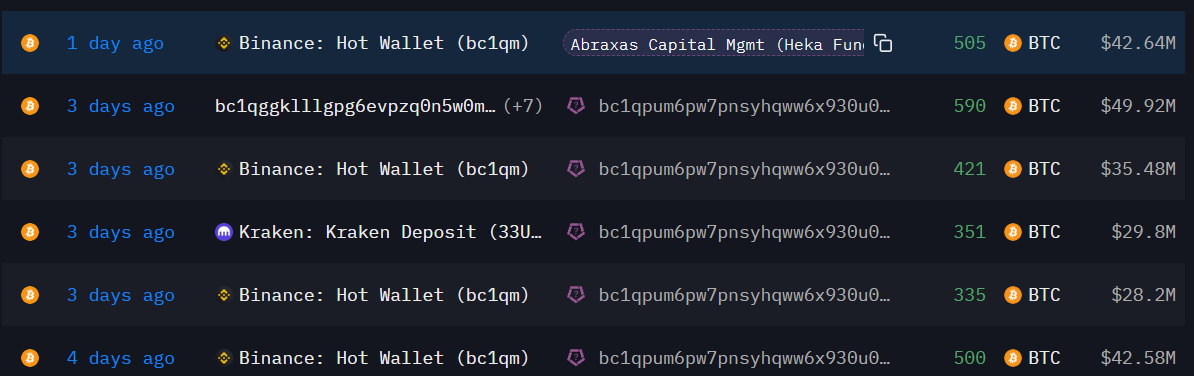

In a bold move underscoring rising institutional confidence in cryptocurrency, Abraxas Capital, a London-based investment firm, has acquired 2,949 Bitcoin (BTC) valued at over $250 million in the days leading up to April 19.

According to Arkham Intelligence data, Abraxas's most recent purchase was over $45 million worth of BTC via Binance on April 18. The timing coincides with broader accumulation trends among institutional investors and crypto whales, who continue to absorb more than 300% of Bitcoin’s annual issuance amid dwindling exchange reserves.

Institutional Confidence Grows Despite Market Fluctuations

This major acquisition comes just days after Michael Saylor’s Strategy firm acquired $285 million in Bitcoin at an average price of $82,618 per coin—a move reinforcing the sentiment that big players remain bullish despite increasing global tariff tensions and short-term price unpredictability.

CryptoQuant analyst Mignolet flagged potential near-term volatility, citing that over 170,000 BTC have re-entered circulation from medium-term holders (those holding coins between three to six months). This shift is historically correlated with market turbulence.

However, Bitfinex analysts emphasized that these on-chain movements may not immediately impact prices, especially during quieter trading periods:

“The effect of this metric on LTF moves is overstated as large onchain movement of coins hardly ever affects weekend price action since it’s not on liquid markets or CEX markets,” they said.

They also noted that funding rates remain flat and that U.S. markets were closed for Easter weekend, suggesting muted volatility unless unexpected geopolitical developments occur.